Back to BlogLead Time

Why Your Production Doesn't Start Immediately After Sample Approval

2026-01-09

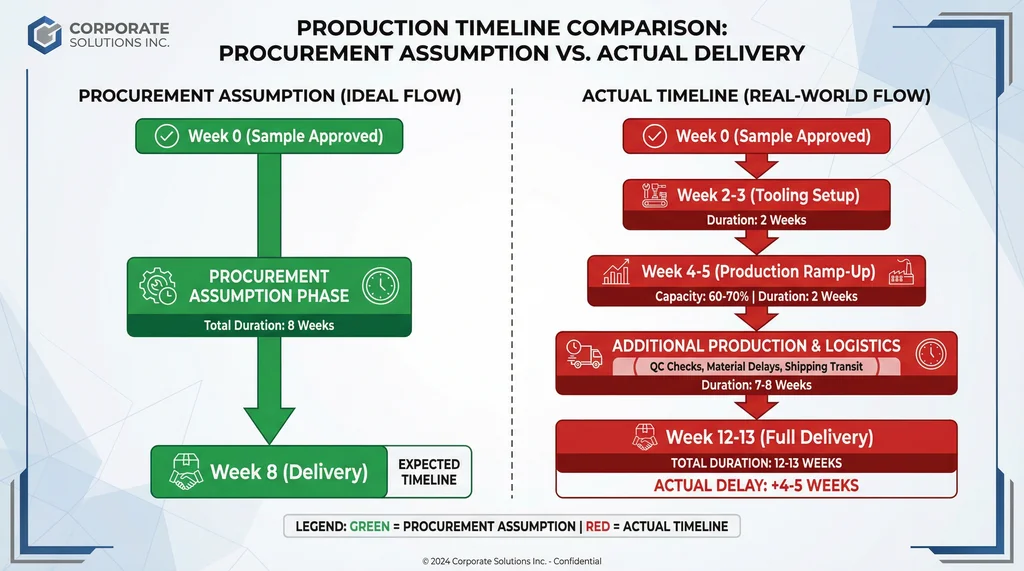

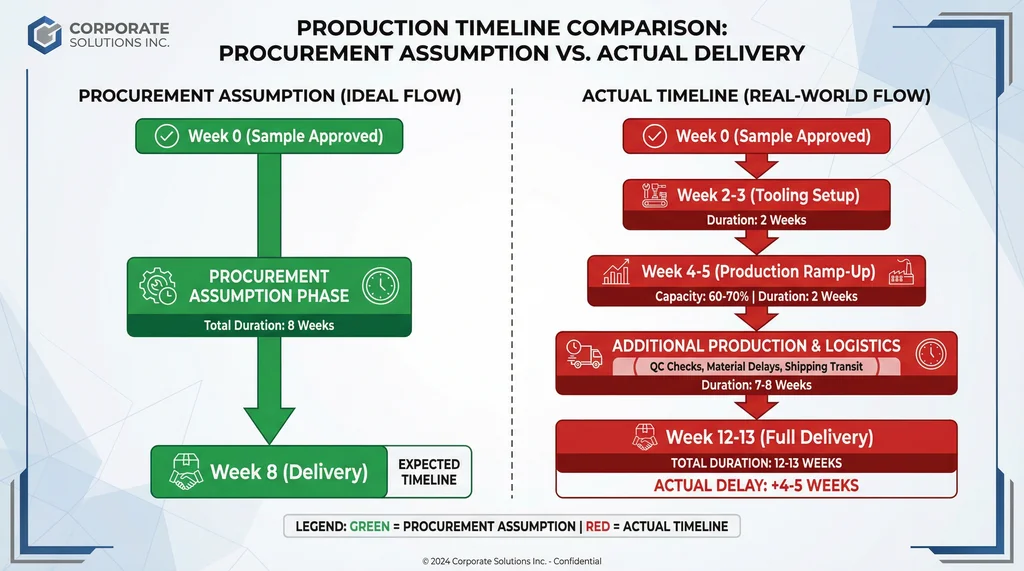

When a procurement team receives the news that their sample has been approved, the natural assumption is that production can now begin in earnest. The factory has confirmed the design, the materials are specified, and the timeline provided in the original quote should now apply. Yet in practice, this is often where lead time decisions start to be significantly misjudged. The approval of a sample does not signal the beginning of production—it signals the beginning of a distinct and often underestimated phase that sits between sample validation and the start of full production runs.

From a factory operations perspective, the gap between sample approval and the first production shipment is rarely discussed with procurement teams, yet it represents one of the most variable and consequential phases of the entire manufacturing timeline. This phase encompasses tooling setup, production ramp-up, and first article inspection—a sequence of activities that can extend the total lead time by 2-4 weeks beyond what procurement teams expect based on their original production quote.

The confusion arises because factories typically provide a single "production lead time" figure that assumes all preparation work has already been completed. When a factory quotes "8 weeks for production," that figure is calculated based on steady-state production—the time required to manufacture boxes once all equipment is configured, all tooling is in place, and the production process is running at full efficiency. However, this quote does not account for the fact that before steady-state production can begin, a series of setup and validation activities must occur. These activities are not optional, and they cannot be compressed without introducing quality risk.

Consider a typical scenario for a custom rigid gift box order. The procurement team approves the sample design on a Friday. They expect production to begin the following Monday, with the factory's 8-week production timeline now in effect. However, on Monday, the factory's production team is not yet running the approved design on the main production line. Instead, they are in the tooling setup phase. The die-cutting dies must be configured and calibrated for the specific box dimensions and fold patterns. The printing equipment must be set up with the correct color specifications, and test runs must be conducted to ensure color accuracy matches the approved sample. The embossing or foiling equipment, if used, must be calibrated for the specific substrate and finish. Quality control test runs must be performed to validate that the first production units meet specification.

This tooling setup phase typically requires 1-3 weeks, depending on the complexity of the design and the number of different production steps involved. During this time, the factory is not producing saleable units—it is preparing to produce them. Yet procurement teams frequently interpret this period as part of the production timeline, expecting that the factory is already manufacturing boxes at full capacity. When the factory reports that production is still in the setup phase after two weeks have passed, procurement teams often perceive this as a delay or inefficiency, rather than recognizing it as a necessary and standard part of the manufacturing process.

Once tooling setup is complete, the factory enters the production ramp-up phase. This phase is characterized by initial production runs at lower-than-steady-state efficiency. The first production batches often reveal minor issues that were not apparent during sample validation—small adjustments to die pressure, minor color calibrations, or substrate-specific handling requirements. These issues are discovered and corrected during the first few production runs, which means the initial output is lower than the factory's stated production capacity. Additionally, the first production runs typically have higher scrap rates as operators become familiar with the specific design and as the equipment reaches optimal performance settings.

The production ramp-up phase typically extends 1-2 weeks, during which the factory is producing units but at a rate that is 60-70% of steady-state capacity. From a procurement perspective, this phase is often invisible. The factory is producing, but not at the rate that procurement teams expect based on the original production quote. When procurement teams calculate expected delivery dates, they typically assume that production begins at full capacity on day one. In reality, production begins at reduced capacity and gradually increases to full capacity over the course of 1-2 weeks.

The practical consequence of this misunderstanding is significant. A factory that quotes "8 weeks for production" is quoting the time required to produce the full order once the production process is running at steady state. However, if the order requires 2-3 weeks of tooling setup and 1-2 weeks of production ramp-up before steady-state production begins, the actual lead time from sample approval to delivery is 11-13 weeks, not 8 weeks. Procurement teams that do not account for this phase frequently discover that their expected delivery date has slipped by 2-4 weeks, and they interpret this as a factory delay rather than recognizing it as a consequence of their own timeline planning.

The cost implications of this blind spot are equally significant. During the tooling setup and production ramp-up phases, the factory's efficiency is lower than during steady-state production. Setup activities require skilled labor and machine time that do not directly produce saleable units. Production ramp-up runs have higher scrap rates and lower output per machine hour. These inefficiencies are typically absorbed by the factory as part of the cost of doing business, but they do increase the per-unit cost of the order, particularly for smaller orders where the setup and ramp-up phases represent a larger proportion of the total production time.

Additionally, the first production runs often reveal quality issues that were not apparent during sample validation. A sample is typically produced using manual or semi-manual processes, with close oversight and quality control at every step. Full production runs, by contrast, are automated and rely on machine settings and operator consistency. When the first production batches reveal quality issues—such as minor color variations, substrate handling problems, or embossing inconsistencies—these issues must be corrected, which requires additional setup time and may result in scrap or rework. Procurement teams that do not anticipate this phase may find themselves facing unexpected quality issues and delays during the production ramp-up phase.

From a factory project management perspective, this phase is also where communication breakdowns frequently occur. Factories understand that tooling setup and production ramp-up are necessary phases, and they typically account for these phases in their internal project planning. However, they often do not explicitly communicate this to procurement teams, either because they assume procurement teams understand the manufacturing process or because they want to present a competitive lead time figure. The result is a mismatch between procurement expectations and factory reality. When the factory reports that production is still in the setup phase two weeks after sample approval, procurement teams are surprised and often frustrated, perceiving the delay as a failure rather than recognizing it as a normal part of the manufacturing process.

The key to avoiding this blind spot is for procurement teams to explicitly ask factories about the tooling setup and production ramp-up phases when negotiating lead times. A transparent factory will provide a breakdown such as: tooling setup (2 weeks) + production ramp-up (1 week) + steady-state production (8 weeks) = total lead time (11 weeks). This breakdown allows procurement teams to understand the full timeline and to plan accordingly. A factory that provides only a single "production lead time" figure without clarifying the setup and ramp-up phases is either not thinking through the full project timeline or is deliberately obscuring these phases to make their quoted lead time appear more competitive.

For corporate gift box projects, where customization is the norm, the tooling setup and production ramp-up phases are particularly significant. A standard rigid box design may require only 1-2 weeks of setup time, but a highly customized design with multiple colors, embossing, and specialty finishes may require 2-3 weeks or more. Similarly, a large order may move through the production ramp-up phase more quickly because the factory can dedicate multiple production lines to the order, whereas a smaller order may require 2-3 weeks of ramp-up time as it shares production capacity with other orders.

Understanding this phase is essential when reading the comprehensive lead time guide for corporate gift boxes, which covers all factors affecting total project duration from order placement to delivery. The tooling setup and production ramp-up phases represent a critical but often overlooked component of the total timeline. By explicitly accounting for these phases in project planning and by asking factories for transparent breakdowns of their lead time estimates, procurement teams can set realistic expectations and avoid the costly surprises that arise when this phase is not anticipated.

The practical implication is that procurement should add 3-5 weeks to any quoted production lead time to account for tooling setup and production ramp-up, assuming the order requires any level of customization. For highly customized orders or orders with complex finishes, this figure may extend to 4-6 weeks. By planning around this hidden timeline, procurement teams can avoid the frustration of discovering that their expected delivery date has shifted, and they can better manage stakeholder expectations around the actual time required to deliver custom corporate gift boxes from order placement to final delivery.

You May Also Like

Rigid Box vs. Corrugated Mailer: Which Material Suits Your Premium Corporate Gifts?

A deep dive into the structural integrity, cost implications, and unboxing experience of rigid boxes versus corrugated mailers for high-end corporate gifting.

Foil Stamping vs. UV Spot: Elevating Your Brand Logo on Custom Gift Boxes

A technical comparison of hot foil stamping and UV spot varnish, analyzing visual impact, durability, and production costs for branded corporate packaging.