Back to BlogLead Time

Why 'Order Confirmed' Doesn't Mean Production Starts on Your Corporate Gift Boxes

2026-01-12

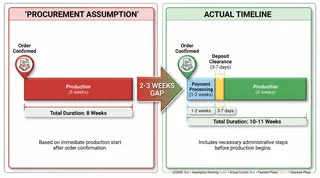

When procurement teams issue a purchase order and receive supplier confirmation, there's a natural assumption that production begins immediately. The order has been placed, the supplier has confirmed receipt, and the timeline clock starts ticking. In practice, the gap between "order confirmed" and "production started" exists because of payment terms—specifically, the requirement for deposit payments before production commences. This gap is rarely communicated clearly in initial quotes, and it's almost never reflected in the "production lead time" figure that procurement teams use for internal planning. The result is a systematic underestimation of total project duration by 1-4 weeks, depending on the payment terms negotiated and the internal approval processes required to release funds.

The misjudgment begins with how "order confirmed" is interpreted. For procurement teams, "order confirmed" means the supplier has acknowledged the purchase order, agreed to the specifications, and committed to the delivery timeline. The assumption is that the supplier will immediately begin procuring materials, scheduling production capacity, and preparing tooling. For suppliers, "order confirmed" means the commercial terms have been agreed upon, but production cannot begin until the deposit payment is received and cleared. This is not a bureaucratic delay—it's a fundamental risk management practice. Suppliers cannot commit capital to material procurement, labor allocation, and production capacity without financial security. The deposit payment serves as proof of buyer commitment and provides the working capital needed to begin production.

The standard payment terms for corporate gift box manufacturing are 30% deposit upon order confirmation, with the remaining 70% due before shipment. These terms are industry-standard across Asia-Pacific manufacturing, and they exist for sound financial reasons. A 5,000-unit corporate gift box order might require $15,000-$25,000 in upfront material costs (packaging materials, printing supplies, ribbons, inserts, branded components). The supplier cannot absorb this cost without a deposit, especially for custom orders where materials cannot be repurposed for other clients. The deposit payment is not profit—it's working capital that allows the supplier to purchase materials and allocate production capacity. Without the deposit, the supplier cannot begin production, regardless of how urgently the buyer needs the goods.

The timeline impact of payment terms is rarely visible in supplier quotes. When a supplier quotes "8 weeks production lead time," that figure refers to the time required to manufacture the goods after materials are procured and production begins. It does not include the time required to process the deposit payment, clear the funds, and initiate material procurement. For procurement teams operating in large organizations, the internal approval process for releasing a $7,500-$12,500 deposit payment can take 3-7 business days. The bank transfer itself takes 1-3 business days for international payments. The supplier's bank requires 1-2 business days to clear the funds and confirm receipt. The total time from "order confirmed" to "deposit received and cleared" is 5-12 business days, or 1-2.5 weeks. This delay is invisible to the procurement team because it occurs before the supplier's "production lead time" clock starts ticking.

The compounding effect occurs when procurement teams use the quoted "production lead time" as the basis for their internal delivery timeline. A procurement manager places an order on January 5th, receives order confirmation on January 6th, and calculates a delivery date of March 2nd (8 weeks production + 1 week shipping). The manager communicates this timeline to internal stakeholders, who plan their corporate event for March 10th. The manager assumes production begins on January 6th, the day the order was confirmed. In reality, production begins on January 20th, after the deposit payment is processed, cleared, and confirmed. The actual delivery date is March 16th, not March 2nd. The procurement manager has underestimated the timeline by 2 weeks, and the corporate event is now at risk.

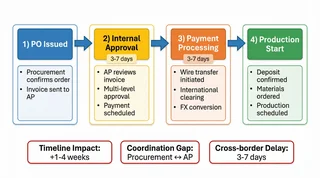

The payment workflow involves multiple steps that are invisible to procurement teams but critical to the timeline. When the procurement team issues a purchase order, the supplier generates a proforma invoice and sends it to the buyer. The buyer's accounts payable department reviews the invoice, verifies the purchase order, and submits the payment for approval. The approval process involves multiple internal stakeholders—procurement manager, finance manager, and potentially a director-level signatory for payments above a certain threshold. Once approved, the payment is processed through the buyer's bank, which initiates an international wire transfer. The wire transfer is routed through correspondent banks, which can add 1-2 days to the processing time. The supplier's bank receives the funds, clears them, and notifies the supplier. The supplier confirms receipt and begins material procurement. This entire workflow takes 5-12 business days, and it occurs before the supplier's "production lead time" begins.

The timeline impact of payment terms is rarely visible in supplier quotes. When a supplier quotes "8 weeks production lead time," that figure refers to the time required to manufacture the goods after materials are procured and production begins. It does not include the time required to process the deposit payment, clear the funds, and initiate material procurement. For procurement teams operating in large organizations, the internal approval process for releasing a $7,500-$12,500 deposit payment can take 3-7 business days. The bank transfer itself takes 1-3 business days for international payments. The supplier's bank requires 1-2 business days to clear the funds and confirm receipt. The total time from "order confirmed" to "deposit received and cleared" is 5-12 business days, or 1-2.5 weeks. This delay is invisible to the procurement team because it occurs before the supplier's "production lead time" clock starts ticking.

The compounding effect occurs when procurement teams use the quoted "production lead time" as the basis for their internal delivery timeline. A procurement manager places an order on January 5th, receives order confirmation on January 6th, and calculates a delivery date of March 2nd (8 weeks production + 1 week shipping). The manager communicates this timeline to internal stakeholders, who plan their corporate event for March 10th. The manager assumes production begins on January 6th, the day the order was confirmed. In reality, production begins on January 20th, after the deposit payment is processed, cleared, and confirmed. The actual delivery date is March 16th, not March 2nd. The procurement manager has underestimated the timeline by 2 weeks, and the corporate event is now at risk.

The payment workflow involves multiple steps that are invisible to procurement teams but critical to the timeline. When the procurement team issues a purchase order, the supplier generates a proforma invoice and sends it to the buyer. The buyer's accounts payable department reviews the invoice, verifies the purchase order, and submits the payment for approval. The approval process involves multiple internal stakeholders—procurement manager, finance manager, and potentially a director-level signatory for payments above a certain threshold. Once approved, the payment is processed through the buyer's bank, which initiates an international wire transfer. The wire transfer is routed through correspondent banks, which can add 1-2 days to the processing time. The supplier's bank receives the funds, clears them, and notifies the supplier. The supplier confirms receipt and begins material procurement. This entire workflow takes 5-12 business days, and it occurs before the supplier's "production lead time" begins.

The risk of timeline slippage increases significantly when payment terms are extended beyond the standard 30% deposit. Some procurement teams negotiate payment terms of "net 30" or "net 60," meaning the full payment is due 30 or 60 days after delivery. These terms are attractive to procurement teams because they improve cash flow and reduce financial risk. For suppliers, these terms are extremely risky, especially for custom orders. A supplier who agrees to "net 60" terms is effectively providing 60 days of interest-free financing to the buyer, plus absorbing the risk of non-payment. Most suppliers will not accept these terms for custom corporate gift box orders, and those who do will require significantly higher pricing to compensate for the financial risk. The procurement team may save 2-3% on payment processing fees, but they will pay 10-15% more in product pricing. The net effect is negative, and the timeline risk increases because suppliers prioritize orders with secure payment terms over orders with extended payment terms.

The hidden cost of payment delays extends beyond timeline slippage—it affects production queue positioning. Suppliers plan their production schedules based on confirmed orders with secured deposits. When a procurement team places an order but delays the deposit payment, the supplier cannot allocate production capacity. The production slot that was tentatively reserved for the buyer is released and filled by another client who has already paid their deposit. When the buyer's deposit finally arrives, the supplier must find a new production slot, which might be 1-2 weeks later than the original slot. The procurement team has not only lost 1-2 weeks to payment processing—they have lost an additional 1-2 weeks to production queue repositioning. The total timeline impact is 2-4 weeks, not the 1-2 weeks that the procurement team expected.

> Understanding the relationship between payment terms and production timelines is essential when considering the full scope of factors that affect project timelines for corporate gift programs. For comprehensive guidance on planning realistic timelines from order placement through final delivery, refer to our [lead time guide for corporate gift boxes](/resources/leadtime-production-guide), which addresses the full spectrum of factors affecting project duration from initial order through final distribution.

The practical solution for procurement teams is to explicitly account for payment processing time when calculating total project timelines. Instead of using the supplier's "production lead time" as the basis for delivery planning, procurement teams should use a "door-to-door timeline" that includes payment processing, material procurement, production, and shipping. A realistic door-to-door timeline for a custom corporate gift box order is: 1-2 weeks for payment processing and material procurement, 8-10 weeks for production, and 1-2 weeks for shipping and customs clearance. The total timeline is 10-14 weeks, not the 8-9 weeks that procurement teams typically budget. By explicitly planning for payment processing time and communicating this timeline to internal stakeholders, procurement teams can avoid the costly surprises that arise when "order confirmed" is mistakenly interpreted as "production started."

The financial discipline required to release deposit payments promptly is often underestimated by procurement teams. In large organizations, the approval process for releasing funds can be slow, especially during month-end or quarter-end periods when finance departments are focused on closing books. Procurement teams should anticipate these delays and initiate the payment approval process before the order is confirmed, not after. By pre-approving the deposit payment and having the funds ready to release immediately upon order confirmation, procurement teams can eliminate 3-7 days of payment processing time. This small operational improvement can prevent significant timeline slippage and ensure that production begins on schedule.

The supplier's perspective on payment terms is fundamentally different from the buyer's perspective. For buyers, payment terms are a financial tool for managing cash flow and reducing risk. For suppliers, payment terms are a risk management tool for ensuring buyer commitment and securing working capital. The disconnect between these perspectives is where timeline misjudgments occur. Buyers assume that "order confirmed" means "production started," while suppliers assume that "order confirmed" means "awaiting deposit payment." The gap between these assumptions is 1-4 weeks, and it's rarely communicated clearly in initial quotes. By understanding the supplier's perspective and explicitly accounting for payment processing time, procurement teams can bridge this gap and plan realistic timelines that account for the full door-to-door journey from order placement to final delivery.

The risk of timeline slippage increases significantly when payment terms are extended beyond the standard 30% deposit. Some procurement teams negotiate payment terms of "net 30" or "net 60," meaning the full payment is due 30 or 60 days after delivery. These terms are attractive to procurement teams because they improve cash flow and reduce financial risk. For suppliers, these terms are extremely risky, especially for custom orders. A supplier who agrees to "net 60" terms is effectively providing 60 days of interest-free financing to the buyer, plus absorbing the risk of non-payment. Most suppliers will not accept these terms for custom corporate gift box orders, and those who do will require significantly higher pricing to compensate for the financial risk. The procurement team may save 2-3% on payment processing fees, but they will pay 10-15% more in product pricing. The net effect is negative, and the timeline risk increases because suppliers prioritize orders with secure payment terms over orders with extended payment terms.

The hidden cost of payment delays extends beyond timeline slippage—it affects production queue positioning. Suppliers plan their production schedules based on confirmed orders with secured deposits. When a procurement team places an order but delays the deposit payment, the supplier cannot allocate production capacity. The production slot that was tentatively reserved for the buyer is released and filled by another client who has already paid their deposit. When the buyer's deposit finally arrives, the supplier must find a new production slot, which might be 1-2 weeks later than the original slot. The procurement team has not only lost 1-2 weeks to payment processing—they have lost an additional 1-2 weeks to production queue repositioning. The total timeline impact is 2-4 weeks, not the 1-2 weeks that the procurement team expected.

> Understanding the relationship between payment terms and production timelines is essential when considering the full scope of factors that affect project timelines for corporate gift programs. For comprehensive guidance on planning realistic timelines from order placement through final delivery, refer to our [lead time guide for corporate gift boxes](/resources/leadtime-production-guide), which addresses the full spectrum of factors affecting project duration from initial order through final distribution.

The practical solution for procurement teams is to explicitly account for payment processing time when calculating total project timelines. Instead of using the supplier's "production lead time" as the basis for delivery planning, procurement teams should use a "door-to-door timeline" that includes payment processing, material procurement, production, and shipping. A realistic door-to-door timeline for a custom corporate gift box order is: 1-2 weeks for payment processing and material procurement, 8-10 weeks for production, and 1-2 weeks for shipping and customs clearance. The total timeline is 10-14 weeks, not the 8-9 weeks that procurement teams typically budget. By explicitly planning for payment processing time and communicating this timeline to internal stakeholders, procurement teams can avoid the costly surprises that arise when "order confirmed" is mistakenly interpreted as "production started."

The financial discipline required to release deposit payments promptly is often underestimated by procurement teams. In large organizations, the approval process for releasing funds can be slow, especially during month-end or quarter-end periods when finance departments are focused on closing books. Procurement teams should anticipate these delays and initiate the payment approval process before the order is confirmed, not after. By pre-approving the deposit payment and having the funds ready to release immediately upon order confirmation, procurement teams can eliminate 3-7 days of payment processing time. This small operational improvement can prevent significant timeline slippage and ensure that production begins on schedule.

The supplier's perspective on payment terms is fundamentally different from the buyer's perspective. For buyers, payment terms are a financial tool for managing cash flow and reducing risk. For suppliers, payment terms are a risk management tool for ensuring buyer commitment and securing working capital. The disconnect between these perspectives is where timeline misjudgments occur. Buyers assume that "order confirmed" means "production started," while suppliers assume that "order confirmed" means "awaiting deposit payment." The gap between these assumptions is 1-4 weeks, and it's rarely communicated clearly in initial quotes. By understanding the supplier's perspective and explicitly accounting for payment processing time, procurement teams can bridge this gap and plan realistic timelines that account for the full door-to-door journey from order placement to final delivery.

The timeline impact of payment terms is rarely visible in supplier quotes. When a supplier quotes "8 weeks production lead time," that figure refers to the time required to manufacture the goods after materials are procured and production begins. It does not include the time required to process the deposit payment, clear the funds, and initiate material procurement. For procurement teams operating in large organizations, the internal approval process for releasing a $7,500-$12,500 deposit payment can take 3-7 business days. The bank transfer itself takes 1-3 business days for international payments. The supplier's bank requires 1-2 business days to clear the funds and confirm receipt. The total time from "order confirmed" to "deposit received and cleared" is 5-12 business days, or 1-2.5 weeks. This delay is invisible to the procurement team because it occurs before the supplier's "production lead time" clock starts ticking.

The compounding effect occurs when procurement teams use the quoted "production lead time" as the basis for their internal delivery timeline. A procurement manager places an order on January 5th, receives order confirmation on January 6th, and calculates a delivery date of March 2nd (8 weeks production + 1 week shipping). The manager communicates this timeline to internal stakeholders, who plan their corporate event for March 10th. The manager assumes production begins on January 6th, the day the order was confirmed. In reality, production begins on January 20th, after the deposit payment is processed, cleared, and confirmed. The actual delivery date is March 16th, not March 2nd. The procurement manager has underestimated the timeline by 2 weeks, and the corporate event is now at risk.

The payment workflow involves multiple steps that are invisible to procurement teams but critical to the timeline. When the procurement team issues a purchase order, the supplier generates a proforma invoice and sends it to the buyer. The buyer's accounts payable department reviews the invoice, verifies the purchase order, and submits the payment for approval. The approval process involves multiple internal stakeholders—procurement manager, finance manager, and potentially a director-level signatory for payments above a certain threshold. Once approved, the payment is processed through the buyer's bank, which initiates an international wire transfer. The wire transfer is routed through correspondent banks, which can add 1-2 days to the processing time. The supplier's bank receives the funds, clears them, and notifies the supplier. The supplier confirms receipt and begins material procurement. This entire workflow takes 5-12 business days, and it occurs before the supplier's "production lead time" begins.

The timeline impact of payment terms is rarely visible in supplier quotes. When a supplier quotes "8 weeks production lead time," that figure refers to the time required to manufacture the goods after materials are procured and production begins. It does not include the time required to process the deposit payment, clear the funds, and initiate material procurement. For procurement teams operating in large organizations, the internal approval process for releasing a $7,500-$12,500 deposit payment can take 3-7 business days. The bank transfer itself takes 1-3 business days for international payments. The supplier's bank requires 1-2 business days to clear the funds and confirm receipt. The total time from "order confirmed" to "deposit received and cleared" is 5-12 business days, or 1-2.5 weeks. This delay is invisible to the procurement team because it occurs before the supplier's "production lead time" clock starts ticking.

The compounding effect occurs when procurement teams use the quoted "production lead time" as the basis for their internal delivery timeline. A procurement manager places an order on January 5th, receives order confirmation on January 6th, and calculates a delivery date of March 2nd (8 weeks production + 1 week shipping). The manager communicates this timeline to internal stakeholders, who plan their corporate event for March 10th. The manager assumes production begins on January 6th, the day the order was confirmed. In reality, production begins on January 20th, after the deposit payment is processed, cleared, and confirmed. The actual delivery date is March 16th, not March 2nd. The procurement manager has underestimated the timeline by 2 weeks, and the corporate event is now at risk.

The payment workflow involves multiple steps that are invisible to procurement teams but critical to the timeline. When the procurement team issues a purchase order, the supplier generates a proforma invoice and sends it to the buyer. The buyer's accounts payable department reviews the invoice, verifies the purchase order, and submits the payment for approval. The approval process involves multiple internal stakeholders—procurement manager, finance manager, and potentially a director-level signatory for payments above a certain threshold. Once approved, the payment is processed through the buyer's bank, which initiates an international wire transfer. The wire transfer is routed through correspondent banks, which can add 1-2 days to the processing time. The supplier's bank receives the funds, clears them, and notifies the supplier. The supplier confirms receipt and begins material procurement. This entire workflow takes 5-12 business days, and it occurs before the supplier's "production lead time" begins.

The risk of timeline slippage increases significantly when payment terms are extended beyond the standard 30% deposit. Some procurement teams negotiate payment terms of "net 30" or "net 60," meaning the full payment is due 30 or 60 days after delivery. These terms are attractive to procurement teams because they improve cash flow and reduce financial risk. For suppliers, these terms are extremely risky, especially for custom orders. A supplier who agrees to "net 60" terms is effectively providing 60 days of interest-free financing to the buyer, plus absorbing the risk of non-payment. Most suppliers will not accept these terms for custom corporate gift box orders, and those who do will require significantly higher pricing to compensate for the financial risk. The procurement team may save 2-3% on payment processing fees, but they will pay 10-15% more in product pricing. The net effect is negative, and the timeline risk increases because suppliers prioritize orders with secure payment terms over orders with extended payment terms.

The hidden cost of payment delays extends beyond timeline slippage—it affects production queue positioning. Suppliers plan their production schedules based on confirmed orders with secured deposits. When a procurement team places an order but delays the deposit payment, the supplier cannot allocate production capacity. The production slot that was tentatively reserved for the buyer is released and filled by another client who has already paid their deposit. When the buyer's deposit finally arrives, the supplier must find a new production slot, which might be 1-2 weeks later than the original slot. The procurement team has not only lost 1-2 weeks to payment processing—they have lost an additional 1-2 weeks to production queue repositioning. The total timeline impact is 2-4 weeks, not the 1-2 weeks that the procurement team expected.

> Understanding the relationship between payment terms and production timelines is essential when considering the full scope of factors that affect project timelines for corporate gift programs. For comprehensive guidance on planning realistic timelines from order placement through final delivery, refer to our [lead time guide for corporate gift boxes](/resources/leadtime-production-guide), which addresses the full spectrum of factors affecting project duration from initial order through final distribution.

The practical solution for procurement teams is to explicitly account for payment processing time when calculating total project timelines. Instead of using the supplier's "production lead time" as the basis for delivery planning, procurement teams should use a "door-to-door timeline" that includes payment processing, material procurement, production, and shipping. A realistic door-to-door timeline for a custom corporate gift box order is: 1-2 weeks for payment processing and material procurement, 8-10 weeks for production, and 1-2 weeks for shipping and customs clearance. The total timeline is 10-14 weeks, not the 8-9 weeks that procurement teams typically budget. By explicitly planning for payment processing time and communicating this timeline to internal stakeholders, procurement teams can avoid the costly surprises that arise when "order confirmed" is mistakenly interpreted as "production started."

The financial discipline required to release deposit payments promptly is often underestimated by procurement teams. In large organizations, the approval process for releasing funds can be slow, especially during month-end or quarter-end periods when finance departments are focused on closing books. Procurement teams should anticipate these delays and initiate the payment approval process before the order is confirmed, not after. By pre-approving the deposit payment and having the funds ready to release immediately upon order confirmation, procurement teams can eliminate 3-7 days of payment processing time. This small operational improvement can prevent significant timeline slippage and ensure that production begins on schedule.

The supplier's perspective on payment terms is fundamentally different from the buyer's perspective. For buyers, payment terms are a financial tool for managing cash flow and reducing risk. For suppliers, payment terms are a risk management tool for ensuring buyer commitment and securing working capital. The disconnect between these perspectives is where timeline misjudgments occur. Buyers assume that "order confirmed" means "production started," while suppliers assume that "order confirmed" means "awaiting deposit payment." The gap between these assumptions is 1-4 weeks, and it's rarely communicated clearly in initial quotes. By understanding the supplier's perspective and explicitly accounting for payment processing time, procurement teams can bridge this gap and plan realistic timelines that account for the full door-to-door journey from order placement to final delivery.

The risk of timeline slippage increases significantly when payment terms are extended beyond the standard 30% deposit. Some procurement teams negotiate payment terms of "net 30" or "net 60," meaning the full payment is due 30 or 60 days after delivery. These terms are attractive to procurement teams because they improve cash flow and reduce financial risk. For suppliers, these terms are extremely risky, especially for custom orders. A supplier who agrees to "net 60" terms is effectively providing 60 days of interest-free financing to the buyer, plus absorbing the risk of non-payment. Most suppliers will not accept these terms for custom corporate gift box orders, and those who do will require significantly higher pricing to compensate for the financial risk. The procurement team may save 2-3% on payment processing fees, but they will pay 10-15% more in product pricing. The net effect is negative, and the timeline risk increases because suppliers prioritize orders with secure payment terms over orders with extended payment terms.

The hidden cost of payment delays extends beyond timeline slippage—it affects production queue positioning. Suppliers plan their production schedules based on confirmed orders with secured deposits. When a procurement team places an order but delays the deposit payment, the supplier cannot allocate production capacity. The production slot that was tentatively reserved for the buyer is released and filled by another client who has already paid their deposit. When the buyer's deposit finally arrives, the supplier must find a new production slot, which might be 1-2 weeks later than the original slot. The procurement team has not only lost 1-2 weeks to payment processing—they have lost an additional 1-2 weeks to production queue repositioning. The total timeline impact is 2-4 weeks, not the 1-2 weeks that the procurement team expected.

> Understanding the relationship between payment terms and production timelines is essential when considering the full scope of factors that affect project timelines for corporate gift programs. For comprehensive guidance on planning realistic timelines from order placement through final delivery, refer to our [lead time guide for corporate gift boxes](/resources/leadtime-production-guide), which addresses the full spectrum of factors affecting project duration from initial order through final distribution.

The practical solution for procurement teams is to explicitly account for payment processing time when calculating total project timelines. Instead of using the supplier's "production lead time" as the basis for delivery planning, procurement teams should use a "door-to-door timeline" that includes payment processing, material procurement, production, and shipping. A realistic door-to-door timeline for a custom corporate gift box order is: 1-2 weeks for payment processing and material procurement, 8-10 weeks for production, and 1-2 weeks for shipping and customs clearance. The total timeline is 10-14 weeks, not the 8-9 weeks that procurement teams typically budget. By explicitly planning for payment processing time and communicating this timeline to internal stakeholders, procurement teams can avoid the costly surprises that arise when "order confirmed" is mistakenly interpreted as "production started."

The financial discipline required to release deposit payments promptly is often underestimated by procurement teams. In large organizations, the approval process for releasing funds can be slow, especially during month-end or quarter-end periods when finance departments are focused on closing books. Procurement teams should anticipate these delays and initiate the payment approval process before the order is confirmed, not after. By pre-approving the deposit payment and having the funds ready to release immediately upon order confirmation, procurement teams can eliminate 3-7 days of payment processing time. This small operational improvement can prevent significant timeline slippage and ensure that production begins on schedule.

The supplier's perspective on payment terms is fundamentally different from the buyer's perspective. For buyers, payment terms are a financial tool for managing cash flow and reducing risk. For suppliers, payment terms are a risk management tool for ensuring buyer commitment and securing working capital. The disconnect between these perspectives is where timeline misjudgments occur. Buyers assume that "order confirmed" means "production started," while suppliers assume that "order confirmed" means "awaiting deposit payment." The gap between these assumptions is 1-4 weeks, and it's rarely communicated clearly in initial quotes. By understanding the supplier's perspective and explicitly accounting for payment processing time, procurement teams can bridge this gap and plan realistic timelines that account for the full door-to-door journey from order placement to final delivery.

You May Also Like

Rigid Box vs. Corrugated Mailer: Which Material Suits Your Premium Corporate Gifts?

A deep dive into the structural integrity, cost implications, and unboxing experience of rigid boxes versus corrugated mailers for high-end corporate gifting.

Foil Stamping vs. UV Spot: Elevating Your Brand Logo on Custom Gift Boxes

A technical comparison of hot foil stamping and UV spot varnish, analyzing visual impact, durability, and production costs for branded corporate packaging.