Back to BlogCustomization Process

Why Your 200-Unit Corporate Gift Box Order Gets Quoted at 3x the Expected Unit Price

2026-01-28

When procurement teams request quotes for custom corporate gift boxes, there's a common assumption that unit pricing scales linearly with quantity. If 1,000 units cost £8 each, then 200 units should cost roughly the same per unit, perhaps with a small premium for the reduced volume. The reality is fundamentally different, and it catches procurement managers off guard with surprising regularity. A 200-unit order might be quoted at £18-24 per unit—not because the supplier is overcharging, but because the economics of custom packaging production don't work the way procurement teams expect them to work.

The misjudgment begins with how customization costs are structured. Every custom corporate gift box project involves two distinct cost categories: variable costs that scale with quantity, and fixed costs that remain constant regardless of how many units are produced. Variable costs include materials (cardboard, paper, ribbon), printing consumables (ink, foil), and direct labour for assembly. These costs do scale roughly linearly with quantity—if you order twice as many boxes, you need twice as much cardboard. Fixed costs, however, are where the economics become counterintuitive. These include cutting die creation, printing plate setup, foil stamping tooling, machine calibration, sample production, and artwork preparation. A cutting die for a custom box structure might cost £300-500 to manufacture, regardless of whether it's used to produce 100 boxes or 10,000 boxes. A printing plate setup might cost £150-250 per colour, regardless of the print run length. These fixed costs create what production managers call the "fixed cost floor"—a minimum investment that must be made before any production can begin.

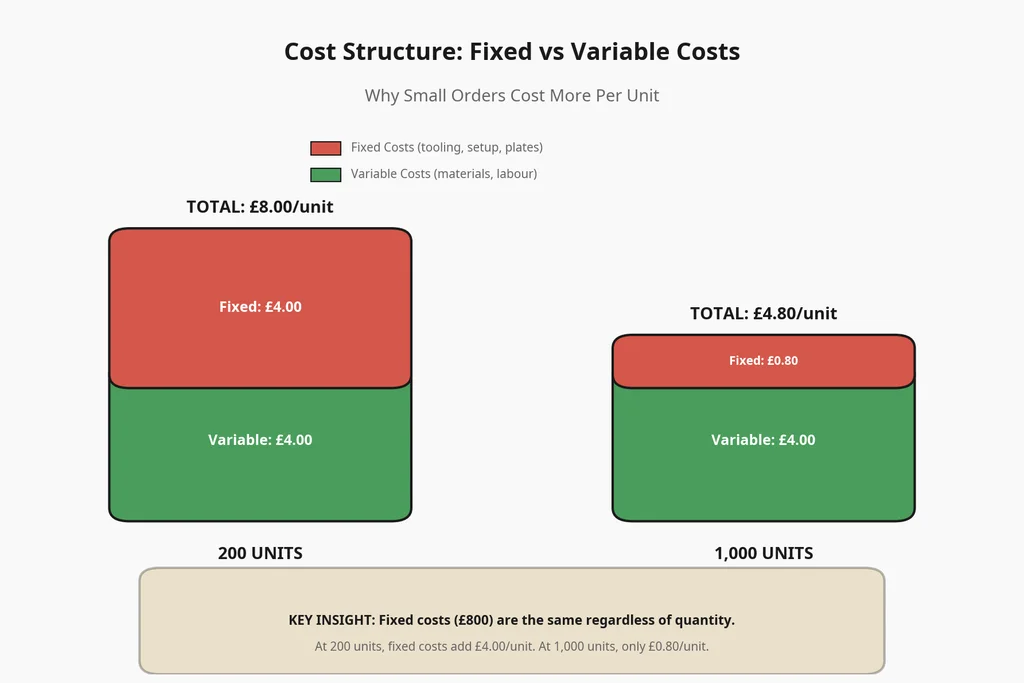

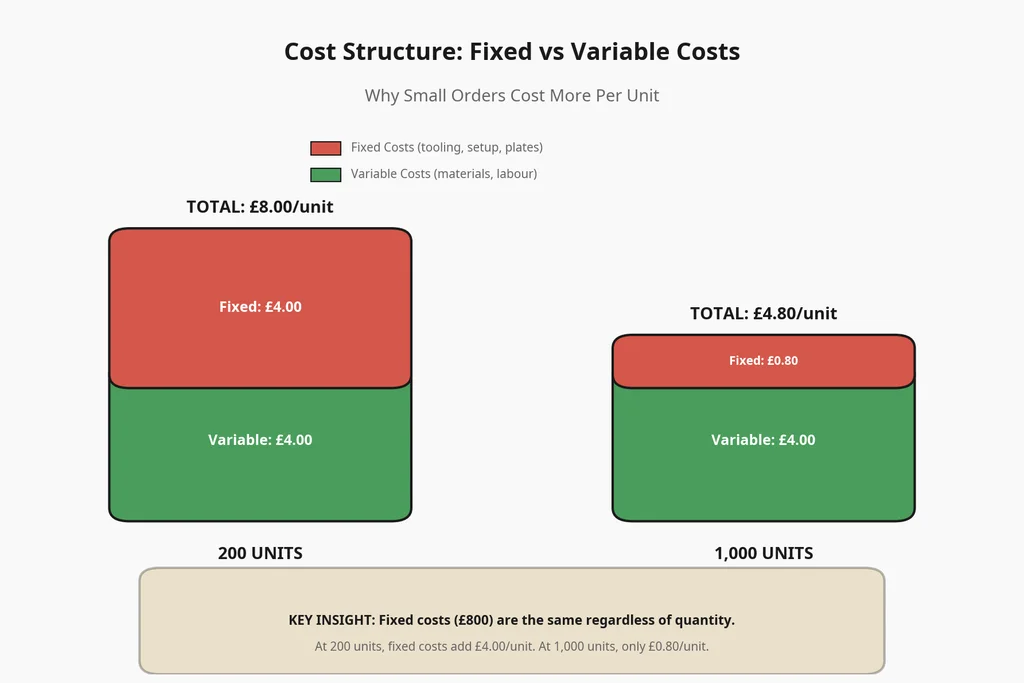

The mathematics of fixed cost amortization explains why small orders appear disproportionately expensive. Consider a custom corporate gift box project with £800 in fixed costs (cutting die, printing plates, tooling setup) and £4 per unit in variable costs (materials, printing, assembly). At 1,000 units, the fixed cost contribution is £0.80 per unit (£800 divided by 1,000), so the total cost per unit is £4.80. At 200 units, the fixed cost contribution is £4.00 per unit (£800 divided by 200), so the total cost per unit is £8.00. The variable cost hasn't changed—it's still £4 per unit—but the fixed cost contribution has increased fivefold. The procurement manager who expected to pay £4.80 per unit for 200 boxes is now looking at £8.00 per unit, and they assume the supplier is adding an unreasonable markup. In reality, the supplier is simply passing through the fixed costs that exist regardless of order quantity.

The situation becomes more pronounced when the customization involves multiple finishing techniques. A corporate gift box with hot foil stamping, embossing, and a custom ribbon closure might have £1,500-2,000 in fixed tooling costs. At 1,000 units, this adds £1.50-2.00 per unit. At 200 units, this adds £7.50-10.00 per unit. The variable costs might be £6 per unit for materials and assembly, but the fixed cost contribution at 200 units pushes the total to £13.50-16.00 per unit—more than double what the procurement manager expected based on the 1,000-unit quote they received from another supplier. The procurement manager might conclude that this supplier is overpriced, when in reality both suppliers have similar cost structures and the difference is entirely explained by fixed cost amortization.

Production efficiency compounds the fixed cost problem in ways that aren't immediately visible to procurement teams. Manufacturing equipment is designed to operate at certain minimum run lengths for optimal efficiency. A printing press might require 30-45 minutes of setup time before the first sheet is printed, regardless of whether the run is 200 sheets or 2,000 sheets. A die-cutting machine might require 20-30 minutes of calibration before the first box is cut. A foil stamping machine might require 15-20 minutes of temperature stabilization and alignment. These setup times represent labour costs that must be recovered, and they're recovered by spreading them across the production run. At 200 units, the setup time might represent 2-3 hours of machine and operator time, which translates to £150-300 in labour costs—or £0.75-1.50 per unit. At 1,000 units, the same setup time is spread across five times as many units, reducing the per-unit impact to £0.15-0.30. The procurement manager sees only the final quote, not the underlying cost structure that explains why small orders carry a disproportionate burden.

The mathematics of fixed cost amortization explains why small orders appear disproportionately expensive. Consider a custom corporate gift box project with £800 in fixed costs (cutting die, printing plates, tooling setup) and £4 per unit in variable costs (materials, printing, assembly). At 1,000 units, the fixed cost contribution is £0.80 per unit (£800 divided by 1,000), so the total cost per unit is £4.80. At 200 units, the fixed cost contribution is £4.00 per unit (£800 divided by 200), so the total cost per unit is £8.00. The variable cost hasn't changed—it's still £4 per unit—but the fixed cost contribution has increased fivefold. The procurement manager who expected to pay £4.80 per unit for 200 boxes is now looking at £8.00 per unit, and they assume the supplier is adding an unreasonable markup. In reality, the supplier is simply passing through the fixed costs that exist regardless of order quantity.

The situation becomes more pronounced when the customization involves multiple finishing techniques. A corporate gift box with hot foil stamping, embossing, and a custom ribbon closure might have £1,500-2,000 in fixed tooling costs. At 1,000 units, this adds £1.50-2.00 per unit. At 200 units, this adds £7.50-10.00 per unit. The variable costs might be £6 per unit for materials and assembly, but the fixed cost contribution at 200 units pushes the total to £13.50-16.00 per unit—more than double what the procurement manager expected based on the 1,000-unit quote they received from another supplier. The procurement manager might conclude that this supplier is overpriced, when in reality both suppliers have similar cost structures and the difference is entirely explained by fixed cost amortization.

Production efficiency compounds the fixed cost problem in ways that aren't immediately visible to procurement teams. Manufacturing equipment is designed to operate at certain minimum run lengths for optimal efficiency. A printing press might require 30-45 minutes of setup time before the first sheet is printed, regardless of whether the run is 200 sheets or 2,000 sheets. A die-cutting machine might require 20-30 minutes of calibration before the first box is cut. A foil stamping machine might require 15-20 minutes of temperature stabilization and alignment. These setup times represent labour costs that must be recovered, and they're recovered by spreading them across the production run. At 200 units, the setup time might represent 2-3 hours of machine and operator time, which translates to £150-300 in labour costs—or £0.75-1.50 per unit. At 1,000 units, the same setup time is spread across five times as many units, reducing the per-unit impact to £0.15-0.30. The procurement manager sees only the final quote, not the underlying cost structure that explains why small orders carry a disproportionate burden.

The shipping economics add another layer of non-linearity that procurement teams often overlook. A 200-unit order of corporate gift boxes might fit into 2-3 cartons, which is too small for economical sea freight but too large for standard courier delivery. The result is air freight or express courier service, which might cost £200-400 for the shipment—or £1.00-2.00 per unit. A 1,000-unit order, by contrast, might fill a quarter of a shipping container and qualify for consolidated sea freight at £0.20-0.40 per unit. The shipping cost differential alone can add £0.60-1.60 per unit to the small order, further widening the gap between expected and actual unit pricing.

The procurement blind spot occurs when managers compare quotes from different suppliers without accounting for the fixed cost structure. A procurement manager might receive a quote of £8 per unit for 1,000 boxes from Supplier A, and then request a quote for 200 boxes from Supplier B. Supplier B quotes £18 per unit, and the procurement manager concludes that Supplier B is 125% more expensive. In reality, if Supplier A were asked to quote 200 units, they would likely quote £16-20 per unit as well—the difference is the order quantity, not the supplier. The procurement manager's comparison is invalid because they're comparing different order quantities, not different suppliers. This misjudgment leads to wasted time requesting additional quotes, damaged supplier relationships when procurement teams accuse suppliers of overcharging, and ultimately the same pricing outcome regardless of which supplier is selected.

The practical implications for corporate gift box procurement are significant. When planning custom packaging projects, procurement teams should understand that there's a minimum economical order quantity below which the fixed cost burden makes customization prohibitively expensive. For most custom corporate gift boxes with standard finishing (printing, basic embossing), this threshold is typically 300-500 units. Below this threshold, the fixed cost contribution exceeds the variable cost, and the per-unit price becomes difficult to justify. For projects requiring complex finishing (hot foil stamping, multiple embossing dies, custom inserts), the threshold might be 500-1,000 units. Procurement teams who need smaller quantities should consider alternative approaches: using standard packaging with custom labels or sleeves, selecting from suppliers' existing designs with logo customization only, or consolidating multiple smaller projects into a single larger order.

The supplier's perspective on small order pricing is fundamentally protective. Experienced suppliers know that small orders carry disproportionate risk: the fixed costs are the same, but the revenue to cover those costs is lower. A supplier who quotes a small order at the same per-unit price as a large order is either absorbing a loss or cutting corners on quality. Neither outcome serves the buyer's interests. When a supplier quotes a small order at a higher per-unit price, they're being transparent about the true cost of production—and that transparency protects both parties from the quality compromises that would otherwise be necessary to make the project economically viable.

When evaluating custom corporate gift box projects with varying quantity requirements, it's essential to understand how order volume affects not just pricing but also customization feasibility and timeline. For comprehensive guidance on structuring projects that balance customization complexity with quantity economics, refer to our [detailed guide on customization planning](/resources/customization-process-guide), which addresses the complete journey from initial concept through final delivery and helps procurement teams make informed decisions about when full customization is appropriate versus when modified approaches might deliver better value.

The solution for procurement teams facing small-quantity requirements is to have an honest conversation with suppliers about the fixed cost structure. Ask the supplier to break down the quote into fixed costs and variable costs, so you can understand exactly where the money is going. Ask whether any fixed costs can be reduced by simplifying the design—for example, using fewer colours, eliminating embossing, or selecting a standard box structure instead of a custom die. Ask whether the tooling can be retained for future orders, so the fixed costs can be amortized across multiple production runs over time. These conversations transform the supplier relationship from adversarial price negotiation to collaborative problem-solving, and they often reveal creative solutions that reduce costs without compromising quality.

The organizational implication is that quantity decisions should be made early in the project planning process, not after designs are finalized and quotes are requested. When a procurement team finalizes a design for 200 custom corporate gift boxes and then discovers that the per-unit price is three times their budget, they face an uncomfortable choice: accept the higher price, simplify the design significantly, or increase the order quantity. All of these options require rework and delay. By understanding the fixed cost structure before design work begins, procurement teams can make informed decisions about customization complexity that align with their quantity requirements and budget constraints. The small investment in understanding production economics upfront prevents the much larger costs of redesign and renegotiation downstream.

The shipping economics add another layer of non-linearity that procurement teams often overlook. A 200-unit order of corporate gift boxes might fit into 2-3 cartons, which is too small for economical sea freight but too large for standard courier delivery. The result is air freight or express courier service, which might cost £200-400 for the shipment—or £1.00-2.00 per unit. A 1,000-unit order, by contrast, might fill a quarter of a shipping container and qualify for consolidated sea freight at £0.20-0.40 per unit. The shipping cost differential alone can add £0.60-1.60 per unit to the small order, further widening the gap between expected and actual unit pricing.

The procurement blind spot occurs when managers compare quotes from different suppliers without accounting for the fixed cost structure. A procurement manager might receive a quote of £8 per unit for 1,000 boxes from Supplier A, and then request a quote for 200 boxes from Supplier B. Supplier B quotes £18 per unit, and the procurement manager concludes that Supplier B is 125% more expensive. In reality, if Supplier A were asked to quote 200 units, they would likely quote £16-20 per unit as well—the difference is the order quantity, not the supplier. The procurement manager's comparison is invalid because they're comparing different order quantities, not different suppliers. This misjudgment leads to wasted time requesting additional quotes, damaged supplier relationships when procurement teams accuse suppliers of overcharging, and ultimately the same pricing outcome regardless of which supplier is selected.

The practical implications for corporate gift box procurement are significant. When planning custom packaging projects, procurement teams should understand that there's a minimum economical order quantity below which the fixed cost burden makes customization prohibitively expensive. For most custom corporate gift boxes with standard finishing (printing, basic embossing), this threshold is typically 300-500 units. Below this threshold, the fixed cost contribution exceeds the variable cost, and the per-unit price becomes difficult to justify. For projects requiring complex finishing (hot foil stamping, multiple embossing dies, custom inserts), the threshold might be 500-1,000 units. Procurement teams who need smaller quantities should consider alternative approaches: using standard packaging with custom labels or sleeves, selecting from suppliers' existing designs with logo customization only, or consolidating multiple smaller projects into a single larger order.

The supplier's perspective on small order pricing is fundamentally protective. Experienced suppliers know that small orders carry disproportionate risk: the fixed costs are the same, but the revenue to cover those costs is lower. A supplier who quotes a small order at the same per-unit price as a large order is either absorbing a loss or cutting corners on quality. Neither outcome serves the buyer's interests. When a supplier quotes a small order at a higher per-unit price, they're being transparent about the true cost of production—and that transparency protects both parties from the quality compromises that would otherwise be necessary to make the project economically viable.

When evaluating custom corporate gift box projects with varying quantity requirements, it's essential to understand how order volume affects not just pricing but also customization feasibility and timeline. For comprehensive guidance on structuring projects that balance customization complexity with quantity economics, refer to our [detailed guide on customization planning](/resources/customization-process-guide), which addresses the complete journey from initial concept through final delivery and helps procurement teams make informed decisions about when full customization is appropriate versus when modified approaches might deliver better value.

The solution for procurement teams facing small-quantity requirements is to have an honest conversation with suppliers about the fixed cost structure. Ask the supplier to break down the quote into fixed costs and variable costs, so you can understand exactly where the money is going. Ask whether any fixed costs can be reduced by simplifying the design—for example, using fewer colours, eliminating embossing, or selecting a standard box structure instead of a custom die. Ask whether the tooling can be retained for future orders, so the fixed costs can be amortized across multiple production runs over time. These conversations transform the supplier relationship from adversarial price negotiation to collaborative problem-solving, and they often reveal creative solutions that reduce costs without compromising quality.

The organizational implication is that quantity decisions should be made early in the project planning process, not after designs are finalized and quotes are requested. When a procurement team finalizes a design for 200 custom corporate gift boxes and then discovers that the per-unit price is three times their budget, they face an uncomfortable choice: accept the higher price, simplify the design significantly, or increase the order quantity. All of these options require rework and delay. By understanding the fixed cost structure before design work begins, procurement teams can make informed decisions about customization complexity that align with their quantity requirements and budget constraints. The small investment in understanding production economics upfront prevents the much larger costs of redesign and renegotiation downstream.

The mathematics of fixed cost amortization explains why small orders appear disproportionately expensive. Consider a custom corporate gift box project with £800 in fixed costs (cutting die, printing plates, tooling setup) and £4 per unit in variable costs (materials, printing, assembly). At 1,000 units, the fixed cost contribution is £0.80 per unit (£800 divided by 1,000), so the total cost per unit is £4.80. At 200 units, the fixed cost contribution is £4.00 per unit (£800 divided by 200), so the total cost per unit is £8.00. The variable cost hasn't changed—it's still £4 per unit—but the fixed cost contribution has increased fivefold. The procurement manager who expected to pay £4.80 per unit for 200 boxes is now looking at £8.00 per unit, and they assume the supplier is adding an unreasonable markup. In reality, the supplier is simply passing through the fixed costs that exist regardless of order quantity.

The situation becomes more pronounced when the customization involves multiple finishing techniques. A corporate gift box with hot foil stamping, embossing, and a custom ribbon closure might have £1,500-2,000 in fixed tooling costs. At 1,000 units, this adds £1.50-2.00 per unit. At 200 units, this adds £7.50-10.00 per unit. The variable costs might be £6 per unit for materials and assembly, but the fixed cost contribution at 200 units pushes the total to £13.50-16.00 per unit—more than double what the procurement manager expected based on the 1,000-unit quote they received from another supplier. The procurement manager might conclude that this supplier is overpriced, when in reality both suppliers have similar cost structures and the difference is entirely explained by fixed cost amortization.

Production efficiency compounds the fixed cost problem in ways that aren't immediately visible to procurement teams. Manufacturing equipment is designed to operate at certain minimum run lengths for optimal efficiency. A printing press might require 30-45 minutes of setup time before the first sheet is printed, regardless of whether the run is 200 sheets or 2,000 sheets. A die-cutting machine might require 20-30 minutes of calibration before the first box is cut. A foil stamping machine might require 15-20 minutes of temperature stabilization and alignment. These setup times represent labour costs that must be recovered, and they're recovered by spreading them across the production run. At 200 units, the setup time might represent 2-3 hours of machine and operator time, which translates to £150-300 in labour costs—or £0.75-1.50 per unit. At 1,000 units, the same setup time is spread across five times as many units, reducing the per-unit impact to £0.15-0.30. The procurement manager sees only the final quote, not the underlying cost structure that explains why small orders carry a disproportionate burden.

The mathematics of fixed cost amortization explains why small orders appear disproportionately expensive. Consider a custom corporate gift box project with £800 in fixed costs (cutting die, printing plates, tooling setup) and £4 per unit in variable costs (materials, printing, assembly). At 1,000 units, the fixed cost contribution is £0.80 per unit (£800 divided by 1,000), so the total cost per unit is £4.80. At 200 units, the fixed cost contribution is £4.00 per unit (£800 divided by 200), so the total cost per unit is £8.00. The variable cost hasn't changed—it's still £4 per unit—but the fixed cost contribution has increased fivefold. The procurement manager who expected to pay £4.80 per unit for 200 boxes is now looking at £8.00 per unit, and they assume the supplier is adding an unreasonable markup. In reality, the supplier is simply passing through the fixed costs that exist regardless of order quantity.

The situation becomes more pronounced when the customization involves multiple finishing techniques. A corporate gift box with hot foil stamping, embossing, and a custom ribbon closure might have £1,500-2,000 in fixed tooling costs. At 1,000 units, this adds £1.50-2.00 per unit. At 200 units, this adds £7.50-10.00 per unit. The variable costs might be £6 per unit for materials and assembly, but the fixed cost contribution at 200 units pushes the total to £13.50-16.00 per unit—more than double what the procurement manager expected based on the 1,000-unit quote they received from another supplier. The procurement manager might conclude that this supplier is overpriced, when in reality both suppliers have similar cost structures and the difference is entirely explained by fixed cost amortization.

Production efficiency compounds the fixed cost problem in ways that aren't immediately visible to procurement teams. Manufacturing equipment is designed to operate at certain minimum run lengths for optimal efficiency. A printing press might require 30-45 minutes of setup time before the first sheet is printed, regardless of whether the run is 200 sheets or 2,000 sheets. A die-cutting machine might require 20-30 minutes of calibration before the first box is cut. A foil stamping machine might require 15-20 minutes of temperature stabilization and alignment. These setup times represent labour costs that must be recovered, and they're recovered by spreading them across the production run. At 200 units, the setup time might represent 2-3 hours of machine and operator time, which translates to £150-300 in labour costs—or £0.75-1.50 per unit. At 1,000 units, the same setup time is spread across five times as many units, reducing the per-unit impact to £0.15-0.30. The procurement manager sees only the final quote, not the underlying cost structure that explains why small orders carry a disproportionate burden.

The shipping economics add another layer of non-linearity that procurement teams often overlook. A 200-unit order of corporate gift boxes might fit into 2-3 cartons, which is too small for economical sea freight but too large for standard courier delivery. The result is air freight or express courier service, which might cost £200-400 for the shipment—or £1.00-2.00 per unit. A 1,000-unit order, by contrast, might fill a quarter of a shipping container and qualify for consolidated sea freight at £0.20-0.40 per unit. The shipping cost differential alone can add £0.60-1.60 per unit to the small order, further widening the gap between expected and actual unit pricing.

The procurement blind spot occurs when managers compare quotes from different suppliers without accounting for the fixed cost structure. A procurement manager might receive a quote of £8 per unit for 1,000 boxes from Supplier A, and then request a quote for 200 boxes from Supplier B. Supplier B quotes £18 per unit, and the procurement manager concludes that Supplier B is 125% more expensive. In reality, if Supplier A were asked to quote 200 units, they would likely quote £16-20 per unit as well—the difference is the order quantity, not the supplier. The procurement manager's comparison is invalid because they're comparing different order quantities, not different suppliers. This misjudgment leads to wasted time requesting additional quotes, damaged supplier relationships when procurement teams accuse suppliers of overcharging, and ultimately the same pricing outcome regardless of which supplier is selected.

The practical implications for corporate gift box procurement are significant. When planning custom packaging projects, procurement teams should understand that there's a minimum economical order quantity below which the fixed cost burden makes customization prohibitively expensive. For most custom corporate gift boxes with standard finishing (printing, basic embossing), this threshold is typically 300-500 units. Below this threshold, the fixed cost contribution exceeds the variable cost, and the per-unit price becomes difficult to justify. For projects requiring complex finishing (hot foil stamping, multiple embossing dies, custom inserts), the threshold might be 500-1,000 units. Procurement teams who need smaller quantities should consider alternative approaches: using standard packaging with custom labels or sleeves, selecting from suppliers' existing designs with logo customization only, or consolidating multiple smaller projects into a single larger order.

The supplier's perspective on small order pricing is fundamentally protective. Experienced suppliers know that small orders carry disproportionate risk: the fixed costs are the same, but the revenue to cover those costs is lower. A supplier who quotes a small order at the same per-unit price as a large order is either absorbing a loss or cutting corners on quality. Neither outcome serves the buyer's interests. When a supplier quotes a small order at a higher per-unit price, they're being transparent about the true cost of production—and that transparency protects both parties from the quality compromises that would otherwise be necessary to make the project economically viable.

When evaluating custom corporate gift box projects with varying quantity requirements, it's essential to understand how order volume affects not just pricing but also customization feasibility and timeline. For comprehensive guidance on structuring projects that balance customization complexity with quantity economics, refer to our [detailed guide on customization planning](/resources/customization-process-guide), which addresses the complete journey from initial concept through final delivery and helps procurement teams make informed decisions about when full customization is appropriate versus when modified approaches might deliver better value.

The solution for procurement teams facing small-quantity requirements is to have an honest conversation with suppliers about the fixed cost structure. Ask the supplier to break down the quote into fixed costs and variable costs, so you can understand exactly where the money is going. Ask whether any fixed costs can be reduced by simplifying the design—for example, using fewer colours, eliminating embossing, or selecting a standard box structure instead of a custom die. Ask whether the tooling can be retained for future orders, so the fixed costs can be amortized across multiple production runs over time. These conversations transform the supplier relationship from adversarial price negotiation to collaborative problem-solving, and they often reveal creative solutions that reduce costs without compromising quality.

The organizational implication is that quantity decisions should be made early in the project planning process, not after designs are finalized and quotes are requested. When a procurement team finalizes a design for 200 custom corporate gift boxes and then discovers that the per-unit price is three times their budget, they face an uncomfortable choice: accept the higher price, simplify the design significantly, or increase the order quantity. All of these options require rework and delay. By understanding the fixed cost structure before design work begins, procurement teams can make informed decisions about customization complexity that align with their quantity requirements and budget constraints. The small investment in understanding production economics upfront prevents the much larger costs of redesign and renegotiation downstream.

The shipping economics add another layer of non-linearity that procurement teams often overlook. A 200-unit order of corporate gift boxes might fit into 2-3 cartons, which is too small for economical sea freight but too large for standard courier delivery. The result is air freight or express courier service, which might cost £200-400 for the shipment—or £1.00-2.00 per unit. A 1,000-unit order, by contrast, might fill a quarter of a shipping container and qualify for consolidated sea freight at £0.20-0.40 per unit. The shipping cost differential alone can add £0.60-1.60 per unit to the small order, further widening the gap between expected and actual unit pricing.

The procurement blind spot occurs when managers compare quotes from different suppliers without accounting for the fixed cost structure. A procurement manager might receive a quote of £8 per unit for 1,000 boxes from Supplier A, and then request a quote for 200 boxes from Supplier B. Supplier B quotes £18 per unit, and the procurement manager concludes that Supplier B is 125% more expensive. In reality, if Supplier A were asked to quote 200 units, they would likely quote £16-20 per unit as well—the difference is the order quantity, not the supplier. The procurement manager's comparison is invalid because they're comparing different order quantities, not different suppliers. This misjudgment leads to wasted time requesting additional quotes, damaged supplier relationships when procurement teams accuse suppliers of overcharging, and ultimately the same pricing outcome regardless of which supplier is selected.

The practical implications for corporate gift box procurement are significant. When planning custom packaging projects, procurement teams should understand that there's a minimum economical order quantity below which the fixed cost burden makes customization prohibitively expensive. For most custom corporate gift boxes with standard finishing (printing, basic embossing), this threshold is typically 300-500 units. Below this threshold, the fixed cost contribution exceeds the variable cost, and the per-unit price becomes difficult to justify. For projects requiring complex finishing (hot foil stamping, multiple embossing dies, custom inserts), the threshold might be 500-1,000 units. Procurement teams who need smaller quantities should consider alternative approaches: using standard packaging with custom labels or sleeves, selecting from suppliers' existing designs with logo customization only, or consolidating multiple smaller projects into a single larger order.

The supplier's perspective on small order pricing is fundamentally protective. Experienced suppliers know that small orders carry disproportionate risk: the fixed costs are the same, but the revenue to cover those costs is lower. A supplier who quotes a small order at the same per-unit price as a large order is either absorbing a loss or cutting corners on quality. Neither outcome serves the buyer's interests. When a supplier quotes a small order at a higher per-unit price, they're being transparent about the true cost of production—and that transparency protects both parties from the quality compromises that would otherwise be necessary to make the project economically viable.

When evaluating custom corporate gift box projects with varying quantity requirements, it's essential to understand how order volume affects not just pricing but also customization feasibility and timeline. For comprehensive guidance on structuring projects that balance customization complexity with quantity economics, refer to our [detailed guide on customization planning](/resources/customization-process-guide), which addresses the complete journey from initial concept through final delivery and helps procurement teams make informed decisions about when full customization is appropriate versus when modified approaches might deliver better value.

The solution for procurement teams facing small-quantity requirements is to have an honest conversation with suppliers about the fixed cost structure. Ask the supplier to break down the quote into fixed costs and variable costs, so you can understand exactly where the money is going. Ask whether any fixed costs can be reduced by simplifying the design—for example, using fewer colours, eliminating embossing, or selecting a standard box structure instead of a custom die. Ask whether the tooling can be retained for future orders, so the fixed costs can be amortized across multiple production runs over time. These conversations transform the supplier relationship from adversarial price negotiation to collaborative problem-solving, and they often reveal creative solutions that reduce costs without compromising quality.

The organizational implication is that quantity decisions should be made early in the project planning process, not after designs are finalized and quotes are requested. When a procurement team finalizes a design for 200 custom corporate gift boxes and then discovers that the per-unit price is three times their budget, they face an uncomfortable choice: accept the higher price, simplify the design significantly, or increase the order quantity. All of these options require rework and delay. By understanding the fixed cost structure before design work begins, procurement teams can make informed decisions about customization complexity that align with their quantity requirements and budget constraints. The small investment in understanding production economics upfront prevents the much larger costs of redesign and renegotiation downstream.

You May Also Like

Rigid Box vs. Corrugated Mailer: Which Material Suits Your Premium Corporate Gifts?

A deep dive into the structural integrity, cost implications, and unboxing experience of rigid boxes versus corrugated mailers for high-end corporate gifting.

Foil Stamping vs. UV Spot: Elevating Your Brand Logo on Custom Gift Boxes

A technical comparison of hot foil stamping and UV spot varnish, analyzing visual impact, durability, and production costs for branded corporate packaging.